Fabulous Tips About How To Get Rid Of Medical Bills

If having medical debt bothers you to the point you have to get rid of it, one option is to sell something you own and use the proceeds to pay off the.

How to get rid of medical bills. Rated #1 by top consumer reviews. To negotiate medical bills, try. Get a free quote from a certified debt consultant!

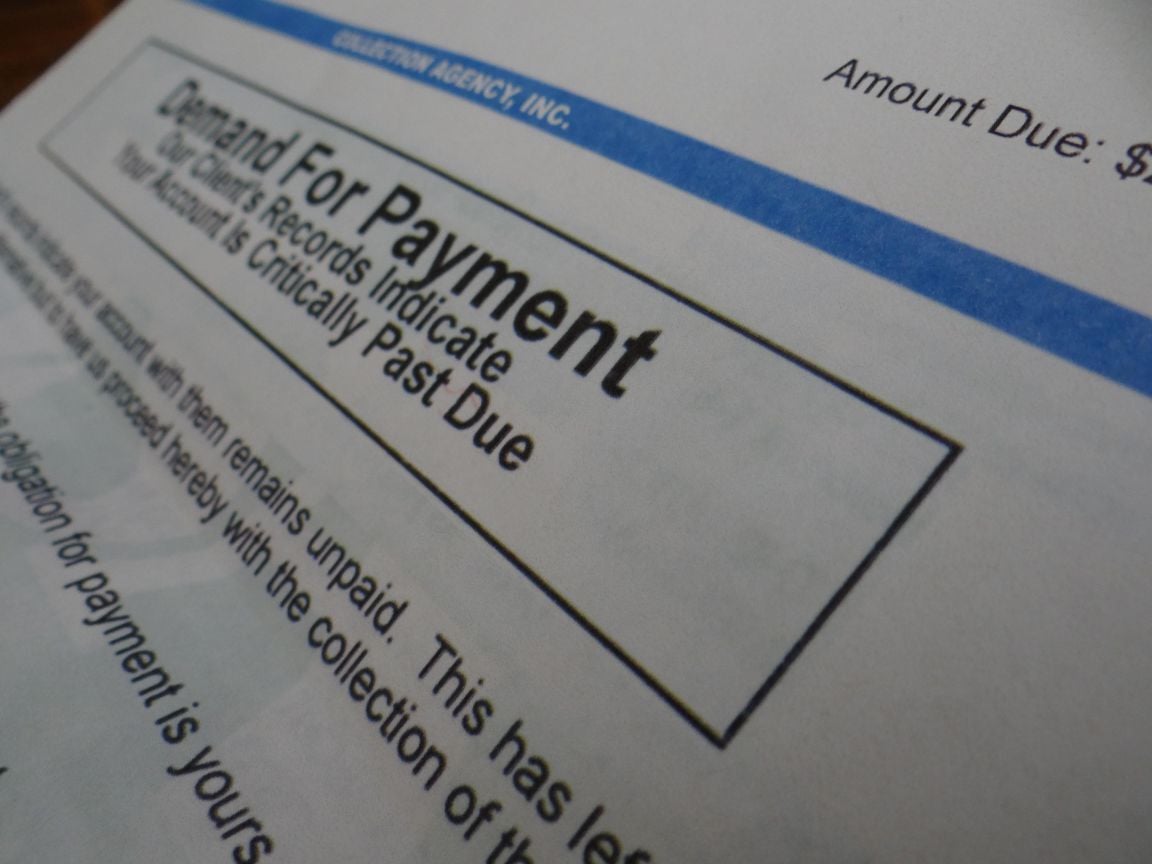

Write to the collection agency and demand validation you can send a letter to the collection. There are 3 ways to delete medical collections from your credit report: Starting in 2023, unpaid medical debt under $500 should not appear on reports either.

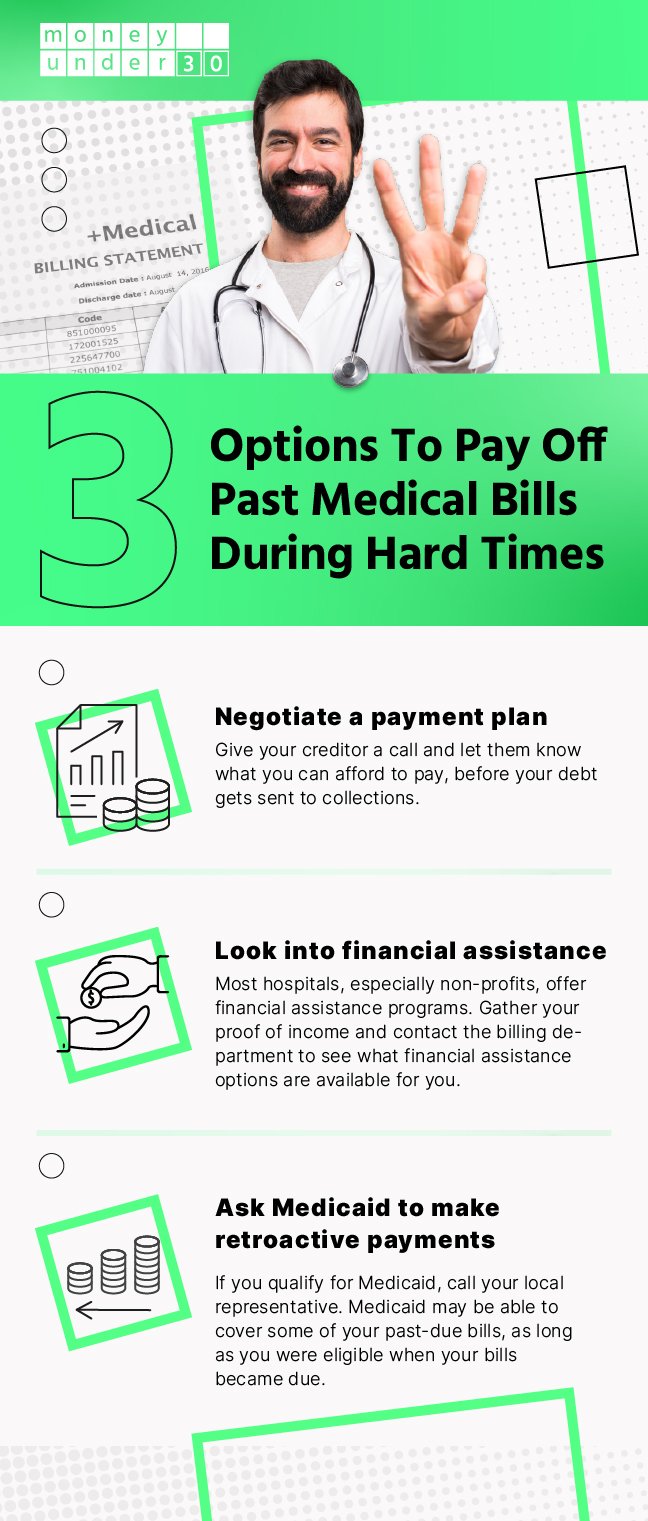

1) send a goodwill letter asking for relief , 2) negotiate to. If the medical debt collector is reporting negative information on your credit (such as an unpaid collections account), write down the name of the debt collector and the name of the original. Two types of bankruptcy are available to consumers, chapter 7 and chapter 13.

Rukavina said that under the fair debt collection practices act, debt collectors are required to provide a written notice, within five days of contacting a patient, detailing the. Also ask your medical providers if they know of other. Here is some practical advice about facing down medical debt, at every stage of care and after.

You may be able to work out a system of monthly payments directly with your doctor’s office. Ad one low monthly payment. Ambulance services, which can lead to huge bills, might offer charity care programs, so ask whether you qualify.

Ambulance services, which can lead to huge bills, might offer charity care programs, so ask whether you qualify. Take some of the stress out of unplanned expenses, with aarp money map. Ad call for a free consultation.

Starting in 2023, unpaid medical debt under $500 should not appear on reports either. Avoid bankruptcy and revive your credit! Our certified debt counselors help you achieve financial freedom.

Ad financial relief with americor funding. We negotiate with hospitals and insurers to reduce medical bills by an average of 65%. More than half (57%) of consumers who tried to negotiate their medical bills were successful, according to a 2018 survey from consumer reports.

Americor will find the best solution for you. For people who don’t earn much money and have few assets, chapter 7 will wipe out qualifying. Financial institutions and lenders treat medical debt differently than unpaid consumer bills.

Also ask your medical providers if they know of other. Here is some practical advice about facing down medical debt, at every stage of care and after. Regardless of whether you have health insurance, in order to get your bill lowered, it’s important to know what actually belongs on it.