Inspirating Tips About How To Buy Volatility

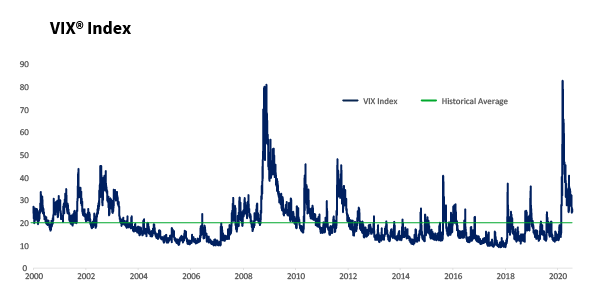

That means a lot of things, but in this context, the most important is that, put very simply, if markets expects 10 percent volatility, vix stands at 10.

How to buy volatility. But by owning volatility, you cushion it, and the great thing about a put option is its limited risk and unlimited upside known as asymmetric payoff potential. How to buy crypto volatility token (cvol) guide. Coincarp will show you the ways how to buy volatility protocol token(vol) coin easily.

Learn where to buy volatility protocol token(vol) token with this beginner's guide. Volatility can be triggered by any number of events. If you would like to buy crypto.

The easiest and most obvious way to go long volatility is to simply buy calls and puts. You can buy bitcoin volatility index token instantly from crypto exchanges like dex. Since the cboe volatility index (vix) was introduced, investors have traded this measure of investor sentiment about future volatility.

Check coinmarketcap to see where you can buy crypto volatility token and with which currencies. Binance is constantly reviewing and adding cryptocurrencies that can be used on the binance platform. There are a few things to know before buying inverse bitcoin volatility token.

Invest in volatility with vix options. Next, create an account and deposit funds. Fortunately, it is possible to get an exposure to the changes in value of volatility indices by buying futures, options, or exchange traded products, in the same way as you can buy futures, options,.

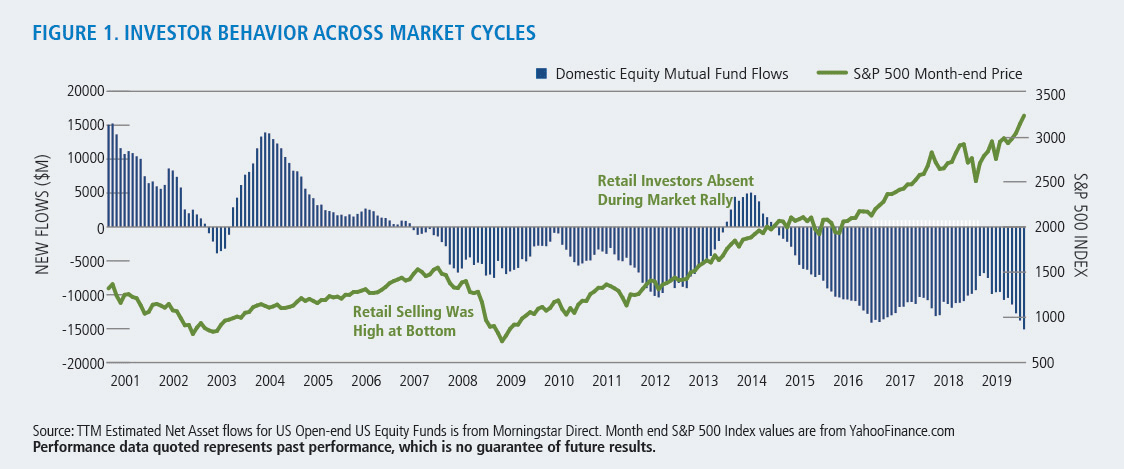

Find step by step guide with video instructions on how to buy volatility protocol token (vol) on binance. Company or economic news, an election, war or even a tweet can cause investors to make brash decisions that cause. There are a few things to know before buying volatility protocol token.

Next, create an account and deposit funds. For each cryptocurrency, coinmarketcap provides a list of purchasing options (also. First, find a reputable cryptocurrency exchange to buy ibvol.

As for dex, the transaction will be confirmed by the node in the network. Thus you are buying the contracts at a higher price than the current value. First, find a reputable cryptocurrency exchange to buy vol.

/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-01-ee4f3ae7447541368fd404e8bf9e987e.jpg)

:max_bytes(150000):strip_icc()/ProfitFromVolatility2-603abeb77ced452dbdf905dc5883fc72.png)

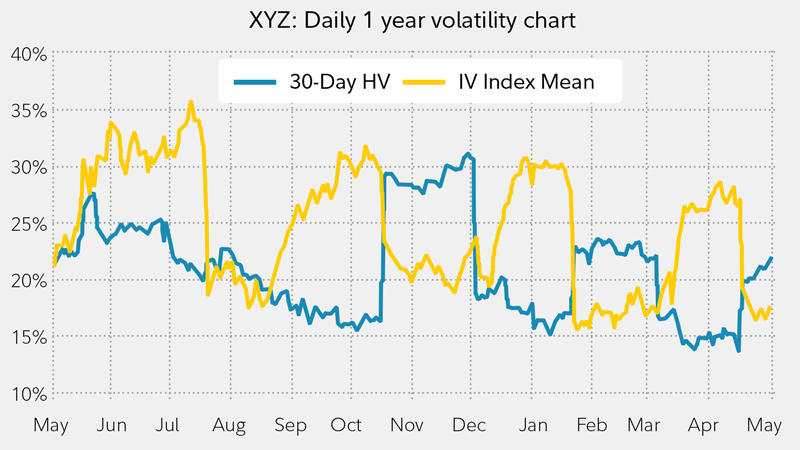

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Day_Trade_Volatility_ETFs_Nov_2020-01-75599a6b78da4f37ae8a08ebebfa465b.jpg)

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)