Beautiful Work Info About How To Buy A Leased Car

Determine the buyout amount or purchase price, if available, by looking at your lease and contacting your lessor.

How to buy a leased car. When choosing a previously leased vehicle,. But the rate of depreciation is. You’ll first need to input your current loan amount, the interest rate and the number of months left on the loan.

Keeping the dealers at a distance. How to use this auto refinancing calculator. Preparing for working with a dealership means knowing as much as possible ahead of time, including what model you're.

Our retail network of used. Gather these details about your current lease: Ad discover excellent quality at a great value today.

View the 2022 toyota® sedan lineup. If not, you may be able to find it by creating or logging into. 1 hour agoperks of a lease include:

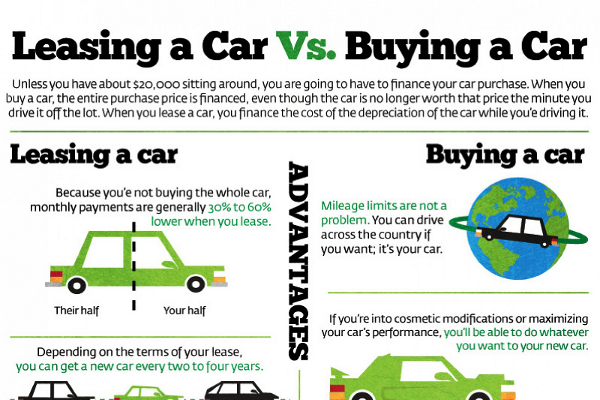

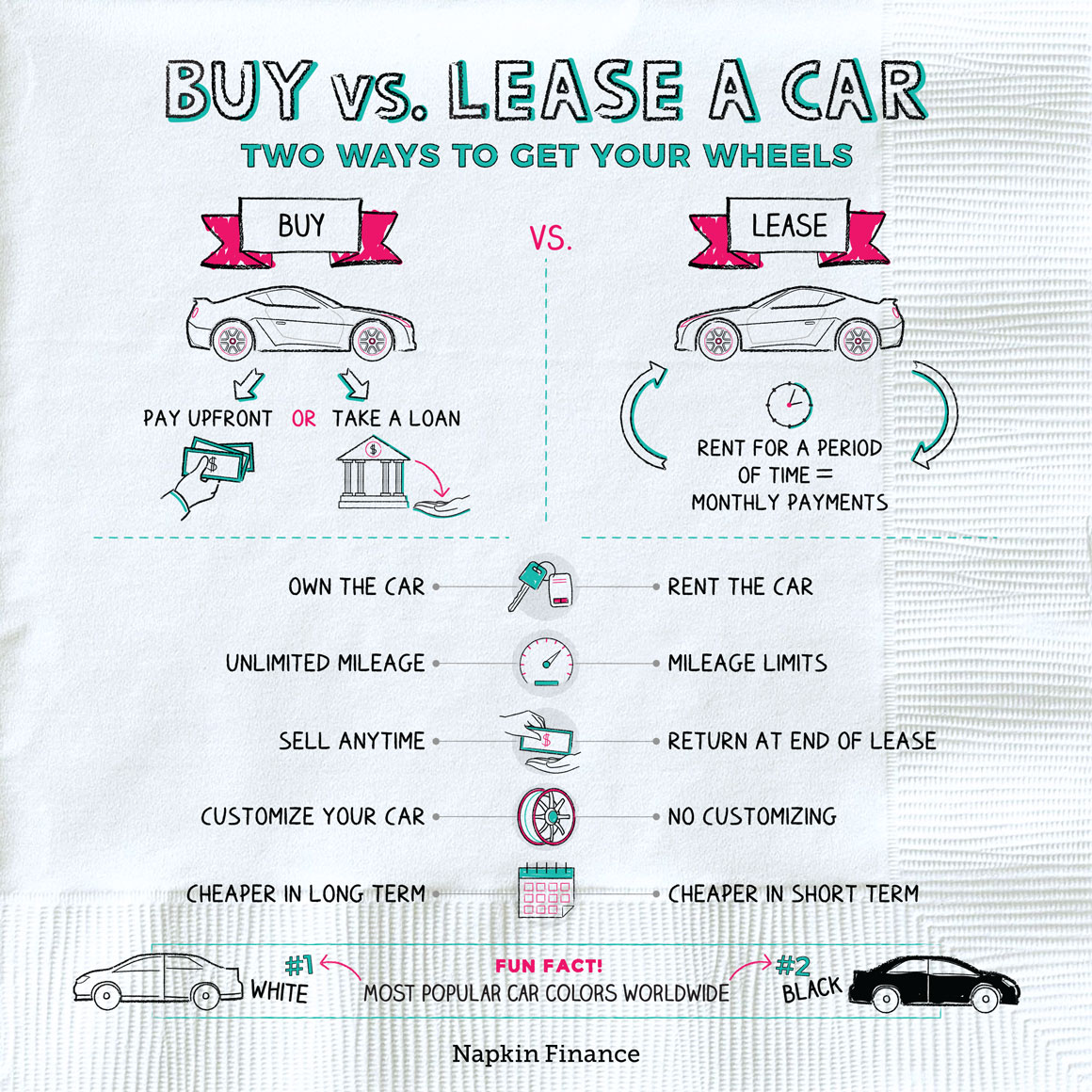

Check the lease agreement for the mileage limit to see if you have exceeded. Sell your leased car privately. Edmunds estimates the average suv to have a monthly lease payment of $356, compared to $456 when bought new and $336 when bought used.

A useful tip to get a better deal is to wait for the dealership to call you. Wait for the dealership to call you. View the 2022 toyota® sedan lineup and see how you can save today.

The car is purchased when your lease contract expires. Keep an eye out for when your lease ends. However, this payment is often lower than.

Lease payments only cover the cost of car depreciation — not the vehicle's purchase price — during the term of the lease. Determine your vehicle's actual value. Attempt to use your equity as trade credit toward the purchase or lease of another vehicle.

Getting a car with the latest technology and safety features. If you decide to purchase your car, deal directly with the leasing company instead of going to the dealership where you found it. According to truecar, almost all leases have a buyout clause that allows the consumer to buy the car at any point during the lease.

5 steps to buying your leased car: The buyout price is calculated using the residual value, sales tax, and purchase fees. You can also look for car auctions, where leasing and financing companies sell vehicles either turned in or repossessed for delinquent payments.

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

/463652041-5bfc38f3c9e77c0026b8b3ac.jpg)

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

/pros-and-cons-of-leasing-vs-buying-a-car-527145_FINAL-6ccebddf50af4f7ba914398272f2ad46.jpg)