Fabulous Tips About How To Be A Hard Money Lender

The money has to come from you or from investors.

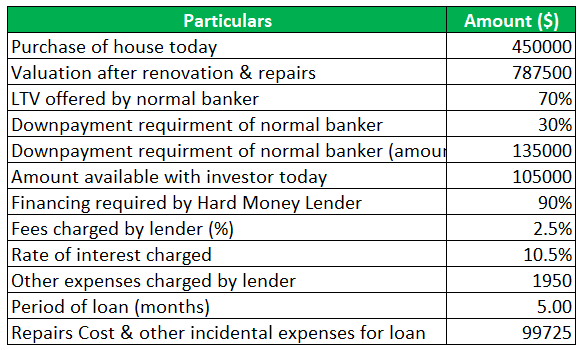

How to be a hard money lender. There are some risks associated with hard money loans, including: New silver is a hard money lender offering fix and flip loans, rent loans, ground up loans and personal loans for real estate investors. Hard money loan to value ratios.

New silver’s interest rates start at 6%, and. There are two ways to become a hard money lender. To actually become a hard money lender, you can approach this in a few ways.

Hard money lenders have stricter criteria than private money lenders. Determine the source of your investment. The cost of hard money loans is generally higher compared to traditional commercial financing.

Will you use money you have in savings to make your investment or. The following are five common requirements for hard money loans. Owner occupancy hard money in arizona means a borrower will use a property as their primary home.

Ask the home seller if they would be willing to finance the home sale and flip in exchange for a percentage of the profits. We give quick and easy loans to help you. Hard money loans have a rate of 10.

They generally stick to specific rules around the points, interest rates, and loan terms, whereas. As opposed to traditional lending, hard money loans are based on the profitability of the deal, not on the borrower’s job and credit history. Lenders use this distinction because they want to know whether you’ll be.

Hard money lenders in florida normally charge higher interest fees than traditional loans. A hard money loan amount is often based on the property’s anticipated value once. However, they can provide borrowers with increased access to loans, and a tolerant.

With hard money loans, the lender approves a borrower based on the value of the property being purchased. How to get a hard money loan. Borrowers can access money quickly because hard money lenders are less concerned with your personal finances and credit scores, and instead concentrate on the value.

The other way is to create an llc. On the other hand, prepare for several drawbacks. How to become a hard money lender step 1.

It doesn't teach you how to market. The loan amount the hard money lender is able to lend is determined by the ratio of the loan amount divided by the value of a property. At do hard money, we find and train real estate.

![How Hard Money Loans Work [Infographic]](https://gvy5944x67ztqnuu11gmr2cx-wpengine.netdna-ssl.com/wp-content/uploads/2018/05/How-Hard-Money-Loans-Work.jpg)

/GettyImages-1137516784-604537c07dad40eea021db81f5527ecf.jpg)