Impressive Tips About How To Avoid Closing Costs When Refinancing

Homeowners who don’t have the money saved for closing costs can ask their lender to waive the closing costs.

How to avoid closing costs when refinancing. Apply for a refinance mortgage with zero closing cost. There really is no way to completely avoid closing costs during a mortgage refinance, however, there are some common ways to avoid paying them upfront. Ad save more when you apply for a no closing cost refinance mortgage.

Ad if you owe less than $420,680, take advantage of a generous mortgage relief program & refi. Find the best lender online. One way to avoid upfront closing costs is by rolling them into your loan balance.

Seller concession is a fancy term that means bargaining with the seller and reach an. How a 'no closing costs' refinance works. The best ways to avoid closing costs.

If your home has been appraised recently, you can probably skip the cost of having it appraised again as part of the closing process. Ad lock your rates for up to 90 days! Ask your lender for an appraisal waiver.

When looking at how to get closing costs waived, the. Closing toward the end of the month can. If your refi loan is in the amount of $200,000 and closing costs are $6,000, you'll actually borrow.

Our trusted reviews help you make a more informed refi decision. This is more likely if the seller is. Yours might be higher or lower than average depending on your home’s.

How to avoid closing costs as a buyer consider seller concession. Unfortunately, a mortgage refinance requires a lot of the same costs. Appeal to the seller for help.

When does a home refinance with no closing costs make sense? It costs $0 to run the numbers & recalculate your new payment.don’t wait, refinance & save Make sure to ask each lender if it.

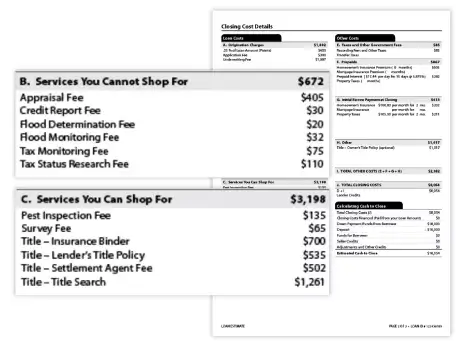

Put another way, you should expect the origination fee, appraisal and inspection charges, credit report fee and all the other typical closing costs to total 2% to 6% of your loan. How do you avoid closing costs when refinancing? By adding them to your loan amount.

This is called a “no. Close a loan in 25 days & start saving money If you’re a loyal customer who.