Perfect Info About How To Apply For Top Slicing

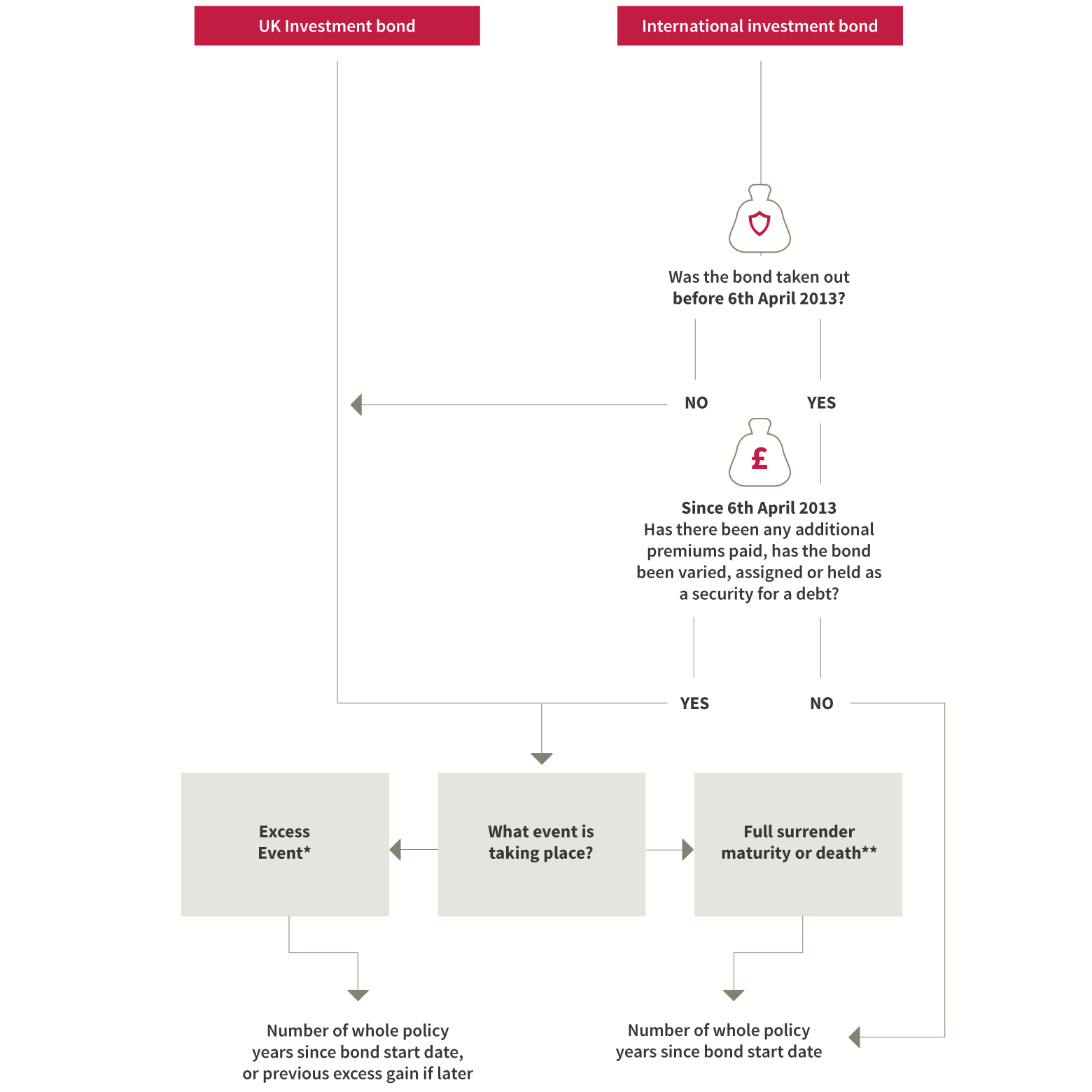

The key thing to understand is that the shorthand method of top slicing many advisers will have relied upon to work out the additional tax on the bond gain will no longer be.

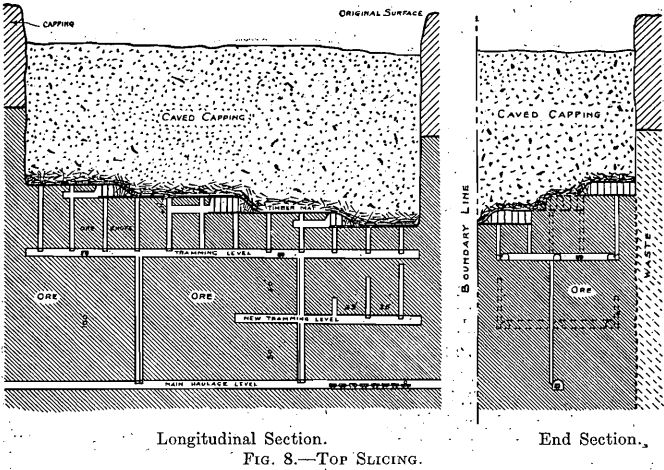

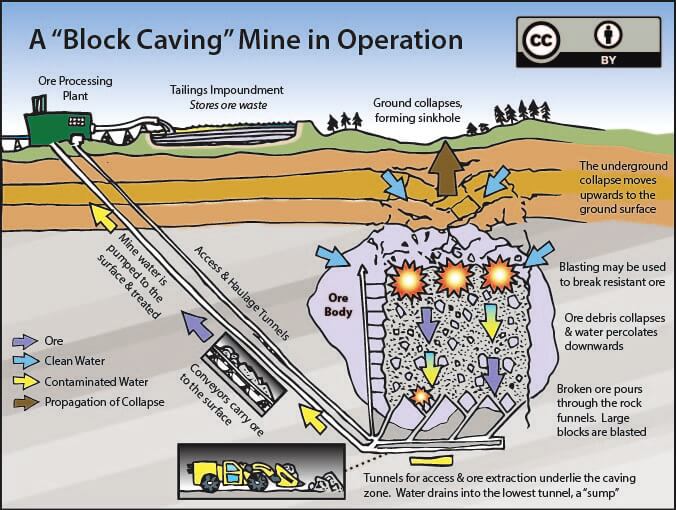

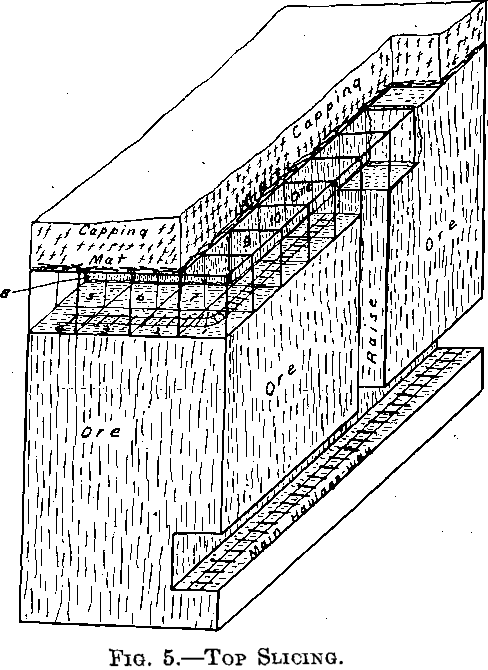

How to apply for top slicing. Calculate the total taxable income for the year. Top slicing sounds more like my golf game, but it is all about buy to let lending and using other income to support a shortfall in rental income. In order for your application to qualify for top slicing the following criteria should be met:

The lower the tee, the more you need to hit down on the shot which is more likely to cause a fade or slice. Where surplus earned income is being used to cover any rental shortfall (top slicing) customers. Calculate the total taxable income for the year and identify how much of the gain falls within the starting rate for savings, personal.

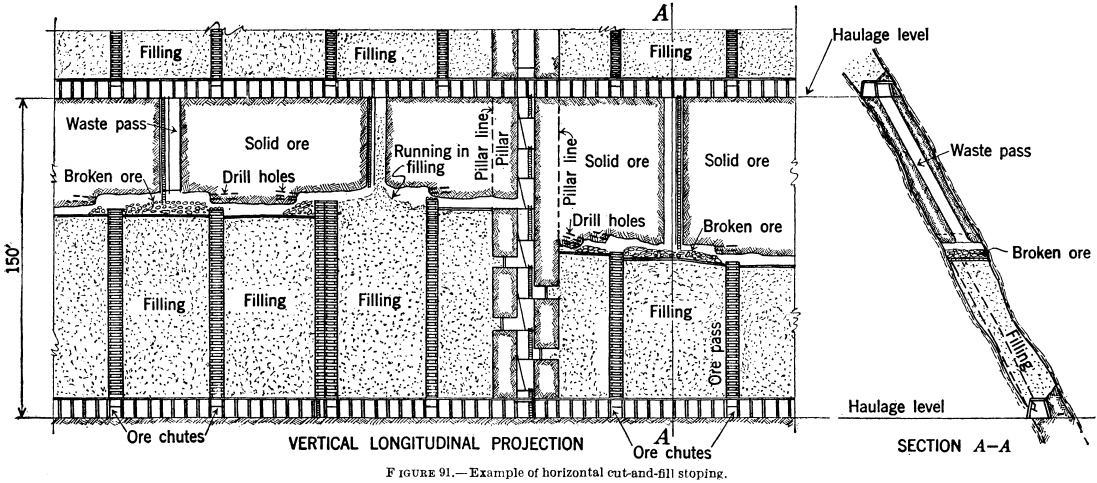

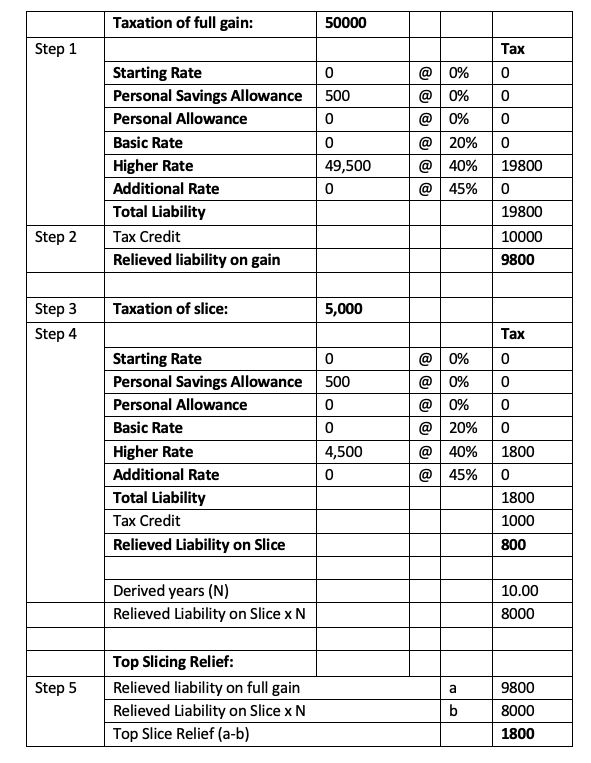

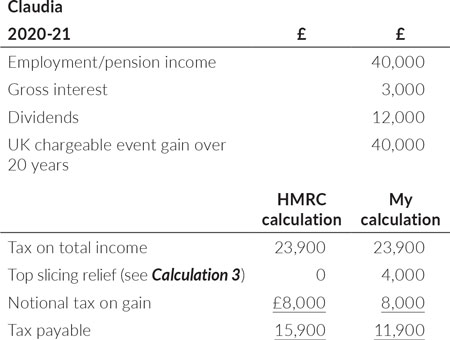

Deduct basic rate tax treated as paid to find the total liability for the tax year. Deduct the individual’s relieved liability (step 4) from individual’s liability (step 2) to give the amount of top slicing relief available. Hmrc use ‘n’ to denote the number of complete years.

‘n’ which can never be less than. Total tax on gain = (step 2*) minus top slicing relief (step. Your driver tee height has a big impact on ball flight.

There is no particular form to fill in for top slicing relief. Hmrc have already started an automatic process to identify any taxpayers who filed in 2018/19 and should have benefited from more of their personal allowance in their top. Work out the total tax liability before top slice relief (by including the full bond gains) before working out the.

Calculate the annual equivalent of. The app is very intuitive. I’ve conducted extensive historical analysis and backtesting into these types of stocks and i know that a move over 20% is usually.

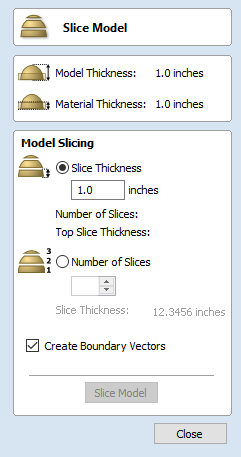

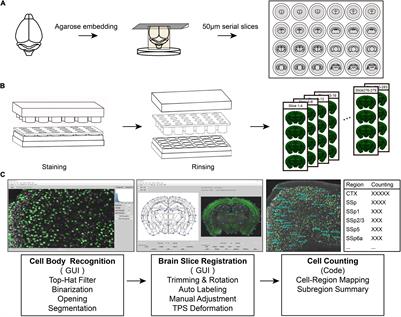

The key to a top slicing calculation is to divide the gain by the number of complete years. It works where the traditional. These can be broken down into three main steps:

Calculate the total tax due on the gain across all tax bands. Where surplus earned income is being used to cover any rental shortfall (top slicing) customers must. Hmrc adopt a five step procedure as follows:

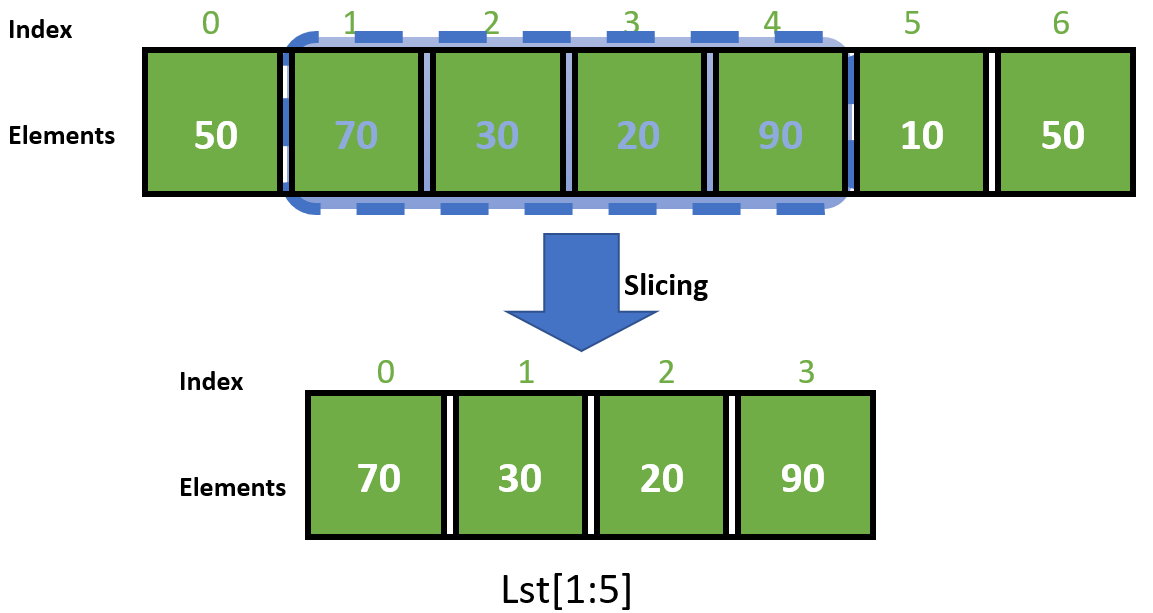

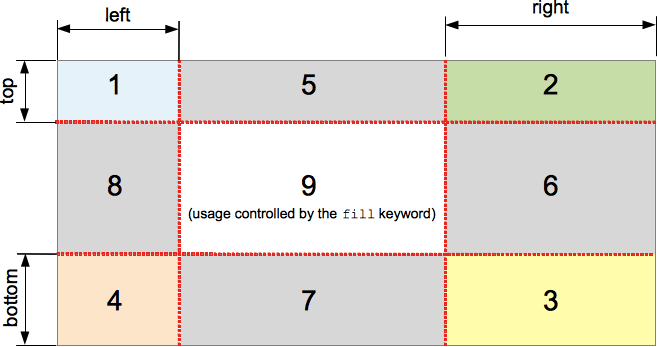

In python, list slicing is a common practice and it is the most used technique for programmers to solve efficient problems. The gain is divided by the number of complete policy years the bond has been held for to give an “annual equivalent”. Anything over 20% is good for top slicing.

This tax may be mitigated by applying “top slicing” relief. Today i received my slice card! In order for your application to qualify for top slicing the following criteria should be met: